Why Xero Is a Great Accounting Software for Tax Accountants

The Shift to Cloud Accounting Is Over — Now It’s About Who Does It Best

Over the past decade, the accounting profession has moved decisively into the cloud. But not all cloud accounting platforms are built with accountants in mind.

4

Among today’s leading platforms, Xero has emerged as one of the most accountant-friendly ecosystems — not just because it helps businesses keep books, but because it helps accounting professionals scale advisory services, automate compliance work, and collaborate with clients in real time.

Here’s why Xero stands out as the best software for modern accounting firms.

1. Built for Real-Time Accounting (Not After-the-Fact Bookkeeping)

Traditional accounting software was built around historical reporting. Xero was built around real-time financial visibility.

With automated bank feeds syncing transactions directly into client books, accountants no longer need to rely on month-end reconciliations to understand financial performance.

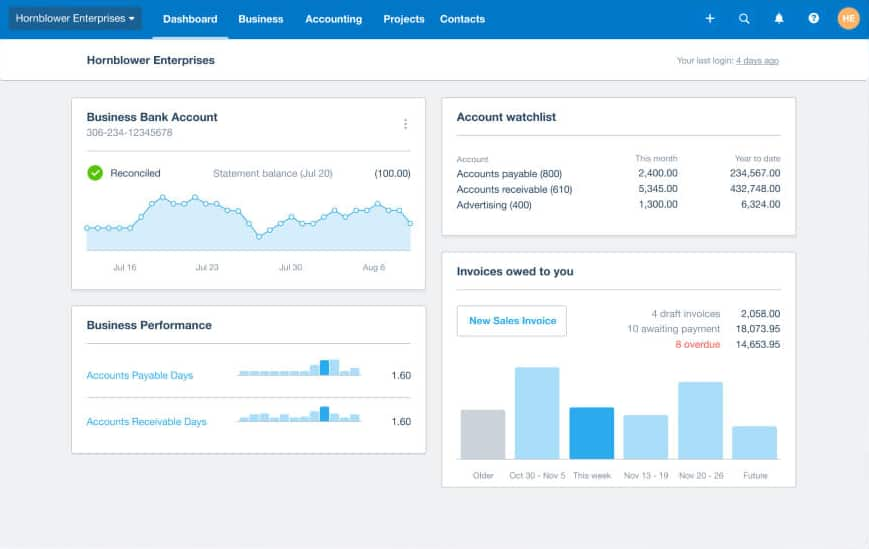

Instead, Xero’s dashboard provides:

- Live bank balances

- Outstanding invoices

- Upcoming bills

- Cash flow trends

- Current financial performance

All updated automatically as transactions occur.

This enables accountants to shift from:

“Here’s what happened last month”

to

“Here’s what you should do this week.”

That’s the difference between compliance work and advisory revenue.

2. Automation That Eliminates Low-Value Work

Accounting firms are under pressure from:

- Staffing shortages

- Margin compression

- Increased compliance demands

Xero addresses all three through workflow automation.

The platform automates:

- Bank reconciliation

- Invoice reminders

- Expense capture

- Payroll processing

- Transaction categorization

Reducing manual data entry improves accuracy while minimizing human error in reconciliation processes.

In practical terms:

Less time spent on data entry =

More time spent on planning, consulting, and tax strategy.

3. Unlimited Users = Firm-Wide Collaboration

Unlike many competing platforms, Xero includes unlimited users across its plans.

That means:

- Partners

- Staff accountants

- Bookkeepers

- Controllers

- Clients

…can all access the same financial data simultaneously with permission-based controls.

This multi-user functionality allows accounting firms to collaborate securely from anywhere while maintaining centralized financial records in one system.

For distributed firms and outsourced accounting teams, this is a major operational advantage.

4. A True Accounting Ecosystem (Not Just Software)

Xero integrates with 1,000+ third-party business applications, one of the largest integration marketplaces among accounting platforms.

These integrations extend into:

- Inventory management

- Payments

- Expense management

- CRM systems

- Payroll providers

- Practice management tools

This flexibility allows accounting firms to build customized tech stacks for:

- E-commerce clients

- Construction companies

- Real estate investors

- Professional services firms

- International businesses (via multi-currency support)

Instead of forcing clients into one workflow, Xero adapts to theirs.

5. Designed for Client Collaboration

Modern accounting is collaborative.

Xero’s cloud-based architecture allows accountants and clients to:

- Work from the same ledger

- Share documents digitally

- Store invoices and receipts

- Respond to queries in real time

Paperless record-keeping reduces manual paperwork while creating a searchable financial database accessible from desktop or mobile devices.

Clients stay engaged.

Books stay current.

Accountants stay proactive.

6. Scalable for Growing Firms

As clients grow, their financial complexity grows with them.

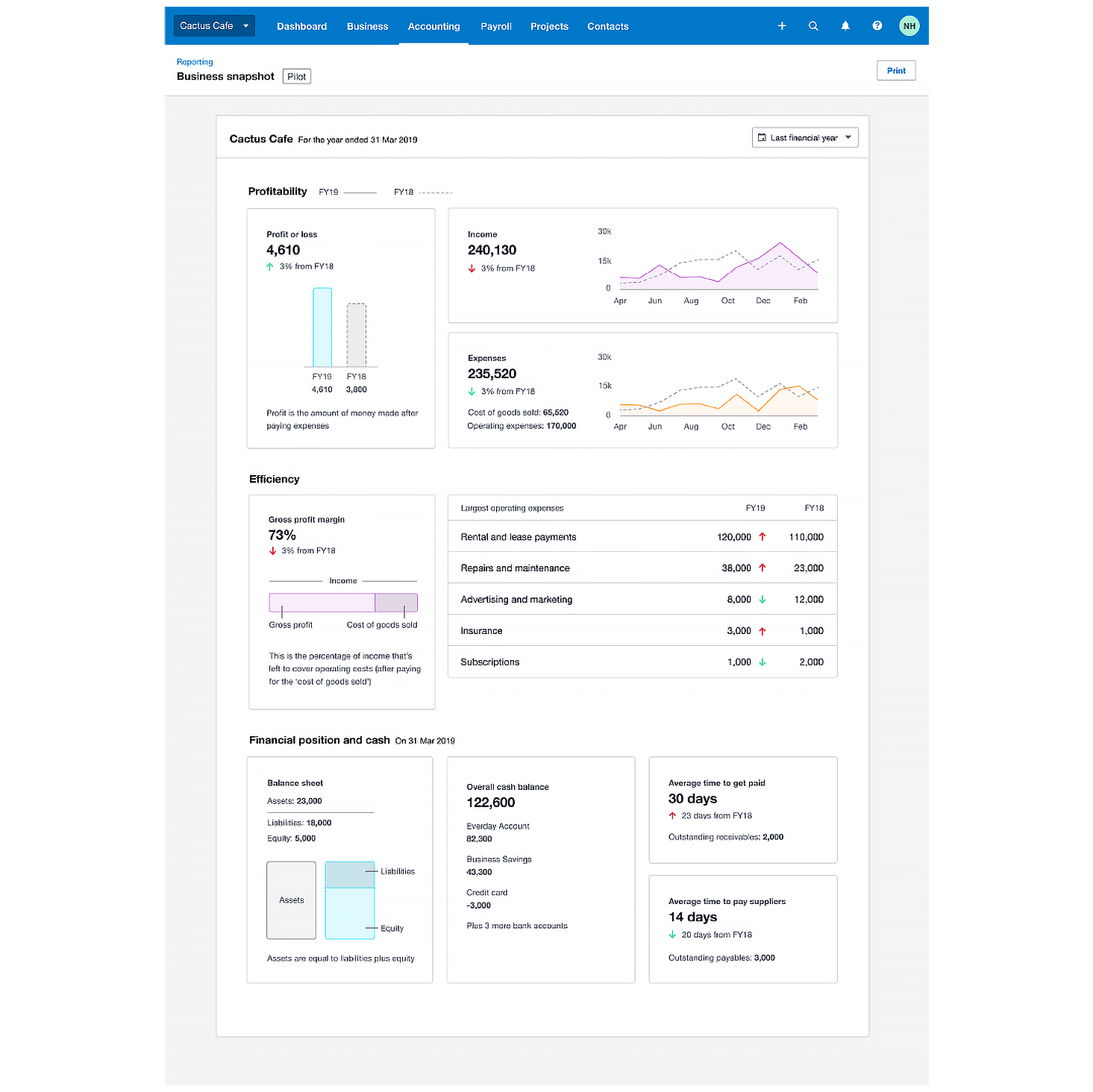

Xero supports:

- Multi-currency transactions

- Online invoicing

- Quotes and billing

- Accounts payable/receivable

- Advanced reporting

All within a cloud environment accessible from anywhere with an internet connection.

And because pricing is feature-based rather than user-based, accounting firms don’t incur additional costs as their internal teams expand.

That makes Xero particularly attractive for firms managing fast-growing SMB clients.

Final Thoughts

Accounting firms are no longer just compliance providers — they are strategic advisors.

Xero supports this transition by:

✔ Automating routine bookkeeping

✔ Delivering real-time financial insights

✔ Enabling client collaboration

✔ Integrating with a broad app ecosystem

✔ Scaling alongside growing businesses

For accountants looking to move up the value chain from bookkeeping to advisory services, Xero isn’t just another accounting platform.

It’s infrastructure for the modern firm.

Responses