-

Robinson DeJesus posted an update

Are you protecting your business? 🛡️

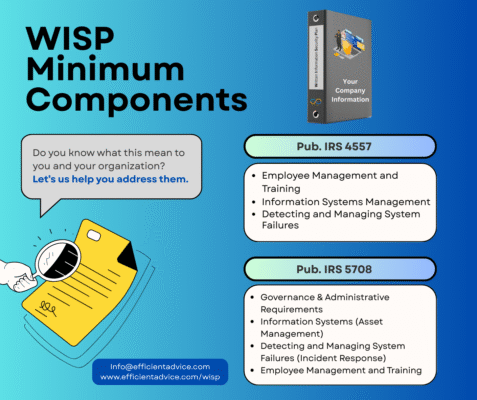

As tax professionals, our clients trust us with their most sensitive data. But are we meeting the IRS Publication 4557 standards to keep that trust?

The IRS requires every pro to have specific safeguards. If you don’t have these, you aren’t just risking a breach—you’re risking your PTIN and your reputation.

The Essentials:

✅ Access Controls: Only the right people see the data.

✅ Secure Email: Protect your communications.

✅ WISP: A documented Written Information Security Plan.Your WISP isn’t just a “piece of paper”—it’s the shield for your practice. Let’s make sure our community is the most compliant and secure in the industry! 💼

Do you already have your WISP documented, or do you need help to get started?

For more information, visit us at; 👇

https://www.efficientadvice.com/wisp

#Negozee #LatinoTaxPro #TaxBusiness #IRSCompliance #WISP