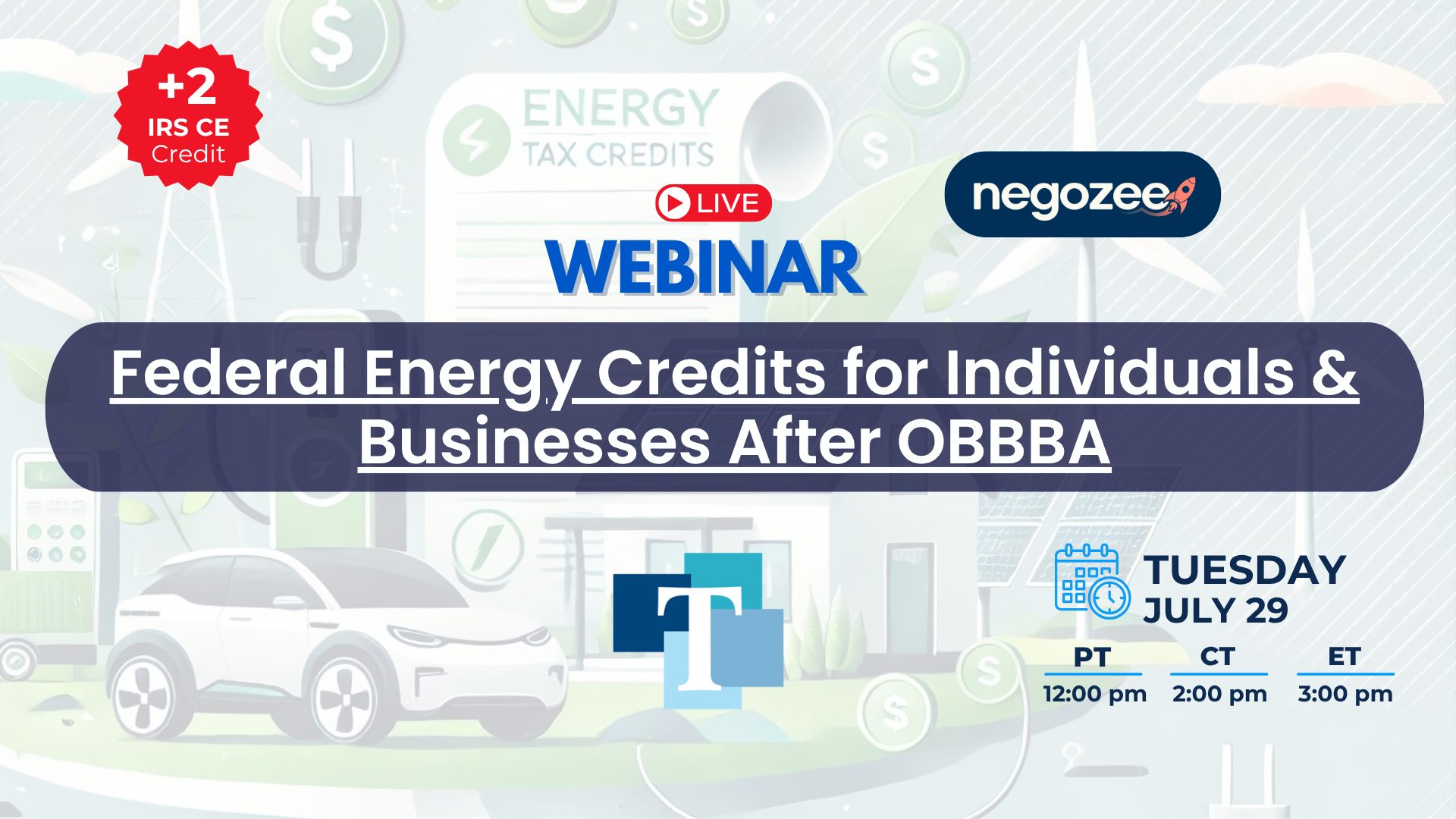

Federal Energy Credits for Individuals & Businesses After OBBBA

This webinar explores the latest IRS guidance, eligibility requirements, and documentation standards for residential energy efficiency improvements, clean vehicles, and commercial energy property. It also examines the newly introduced carryforward, transferability, and recapture provisions, ensuring participants are equipped to maximize credit benefits and avoid compliance pitfalls.

Days

Hours

Minutes

Seconds

2 IRS CE/2 CTEC CE/2 NASBA CPE*

“Our best deal is always to become a monthly subscriber”

https://taxpracticepro.com/become-a-subscriber

*Self-Study recording not available for NASBA CPE credit.

IRS Program #: 7Q3WU-

CTEC Course #: 6248-CE-

Tuesday, July 29, 2025

12:00 p.m Pacific Time Duration: 2 hours

Language

English

Who can attend

Everyone

Dial-in available? (listen only)

Not available.

Responses